As a technical leader, you probably didn’t sign up for the job with aspirations of working with finance on software capitalization. Breaking down development costs for your CFO or finance team is one of the tasks we hear complaints about all the time. That said, it can be strategic for the success of your company, helping increase valuations and attract investment. While it’s certainly not the sexiest work, it’s important work to be done. But you may find yourself asking why. In this article we’ll briefly review just what software capitalization is and why it matters.

Software Capitalization is an accounting practice by which the costs of software R&D are listed as investments instead of expenses. If your company chooses to capitalize some of your R&D costs, they will not be recognized as “losses” immediately on a P&L (profit and loss) sheet, but instead as “assets” on a balance sheet. In this way the costs of, say, developing new software, would be amortized over a period of time.

The argument here is that the cost of that development does not necessarily occur in the same period as when the revenues are earned, and that the cost should therefore be matched up to those future revenues. And if you can prove this direct relationship between costs and future revenues, it’s a good argument (more on that later). For example, if your company spent $1 million in 2020 developing a new application that allows time travelers to visualize the space-time continuum, you might expect to sell a lot of that software once it’s ready in 2021. Therefore, from a business perspective, it might make sense to recognize that $1 million against the revenues that come in throughout 2021 and beyond instead of in 2020 when it was actually spent.

Benefits of Software Capitalization

The reason comes down to business valuation. In tech, most companies’ are assigned value by investors based on their revenues or profits. The most common proxy for profits is Ebitda, or earnings before interest, tax, depreciation and amortization, because it generally indicates the profitability of operating the actual business. By capitalizing R&D costs and amortizing them over time, companies remove them from the Ebitda calculation, effectively increasing profits and therefore the value of the company. For startups with significant R&D costs, that could mean a lot for attracting more investor capital needed to grow or for the eventual outcome for any shareholders in an acquisition.

Skeptical? Don’t be. R&D capitalization is a totally legitimate and well established practice. It is accepted under GAAP (Generally Accepted Accounting Principles) in the U.S. and the IFRS (International Financial Reporting Standards), the latter of which may actually mandate the practice in certain cases. Across the industry, about 57% of public U.S. software companies capitalize some percentage of their R&D spend, though notables such as Salesforce, Amazon, Workday, and Atlassian capitalize less than 1% of their R&D spend. But why not capitalize more?

The Challenge for Capitalizing R&D Costs

As mentioned briefly above, the argument for capitalizing R&D or development costs is a strong one given that you can prove those costs truly relate to future revenues. The problem is that in many, if not most cases, it’s difficult to know for certain which projects will result in future revenues – and how much! – and which will not. Additionally, if your software team is developing more than one product or feature at a time, how do you measure the costs of development for each project in a way that is both accurate and auditable?

To address the first issue, it may take some time and research to develop or use an acceptable framework for valuing and capitalizing intangible assets that are similar to yours. Different industries will do this in different ways, and most industries have analysts and experts that you may need to track down in order to help you out.

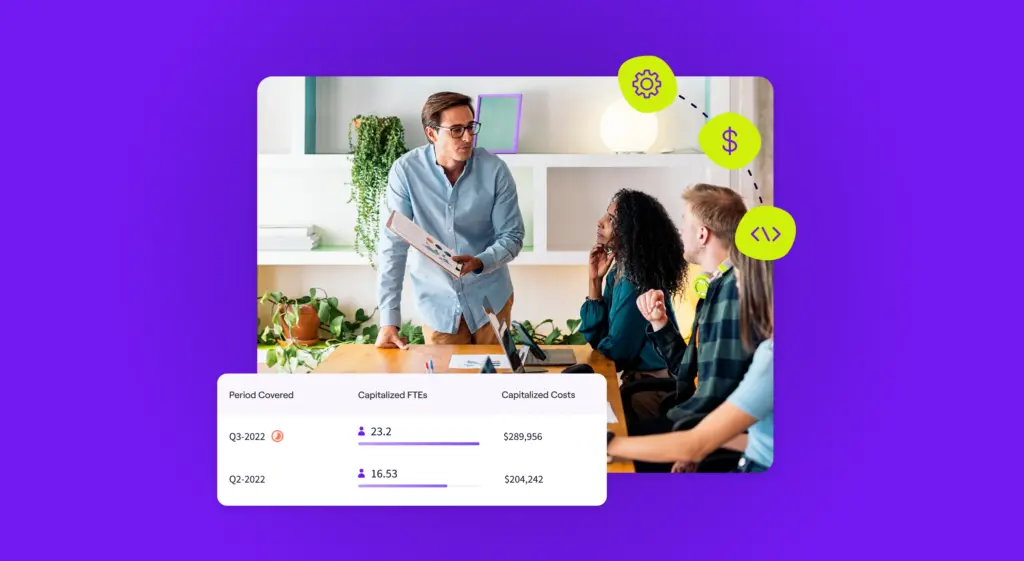

Addressing the second issue is not magic, though it may be more labor intensive that you’d care for without the right tools. You could simply keep a detailed spreadsheet which regularly tracks engineering activities, though without being diligent about this or asking engineers to time-log themselves (I wouldn’t suggest that), manually creating an auditable report is a headache at best. With an Engineering Management Platform (EMP) like Jellyfish, that manual process becomes automatic by measuring the amount of time engineers spend on specific tasks and projects based on signals from the systems they use. EMPs should be able to provide an auditable measurement of the amount of engineering effort spent on capitalizable projects.

Software capitalization can be a challenging task, but it can also be highly valuable to growing tech companies with significant development investments and future revenue potential. To learn more about Jellyfish and how we can help with software capitalization, visit our website and request a demo today.