Shifting engineering work offshore has emerged as a critical trend to both capitalize on global talent – a shift accelerated by the pandemic – and to keep costs low. Recently, these efforts have ramped up to combat challenges around finding workers and to mitigate the costs of rising wages due to inflation.

According to a Wall Street Journal article, a recent Federal Reserve Bank of Atlanta survey found that 7.3% of leadership in the United States plans to move more jobs offshore as the next step from remote work within America. In that same article, Nicholas Bloom, an economist at Stanford University and an expert in workplace matters noted that “About 10% to 20% of U.S. service support jobs, like software developers, human-resources professionals and payroll administrators, could move overseas in the next decade.”

To investigate these claims and assess long-term trends in offshoring engineers, Jellyfish Research (JFR) analyzed roster data from just over 62,000 engineers across 289 companies. In addition to the full cohort of companies, we also analyzed companies backed by PE-firms due to their emphasis on efficiency, scalability and long-term value creation.

For this study, offshore engineers are defined as engineers whose location – provided to Jellyfish through their HRIS – differs from their parent company’s primary billing address country.

Here’s what we found:

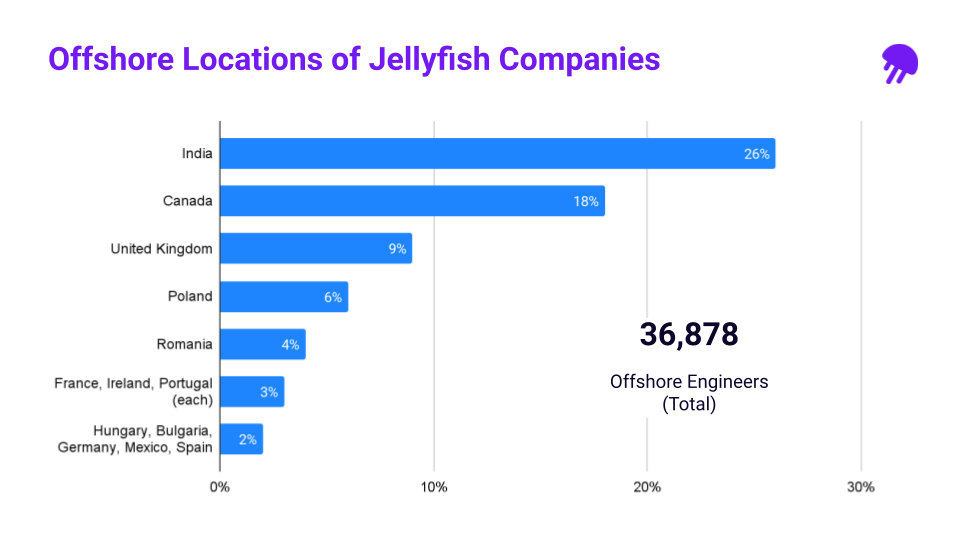

- India (26% of all offshore engineers) is the most prominent offshore engineering location, followed by Canada (18%), the UK (9%), and Poland (6%)

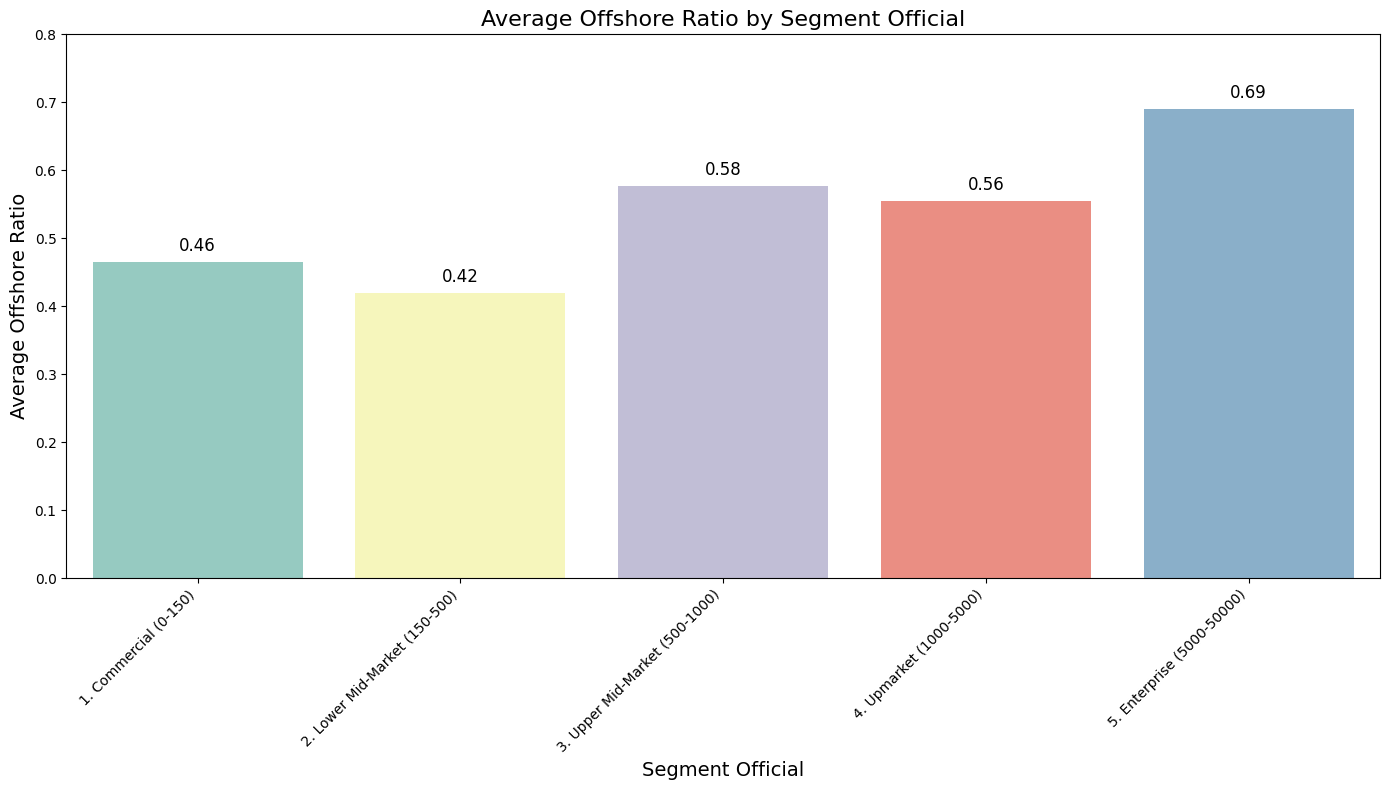

- The ratio of offshore engineers increases as company size increases, as high as 71.3% for 5,000+ employee companies

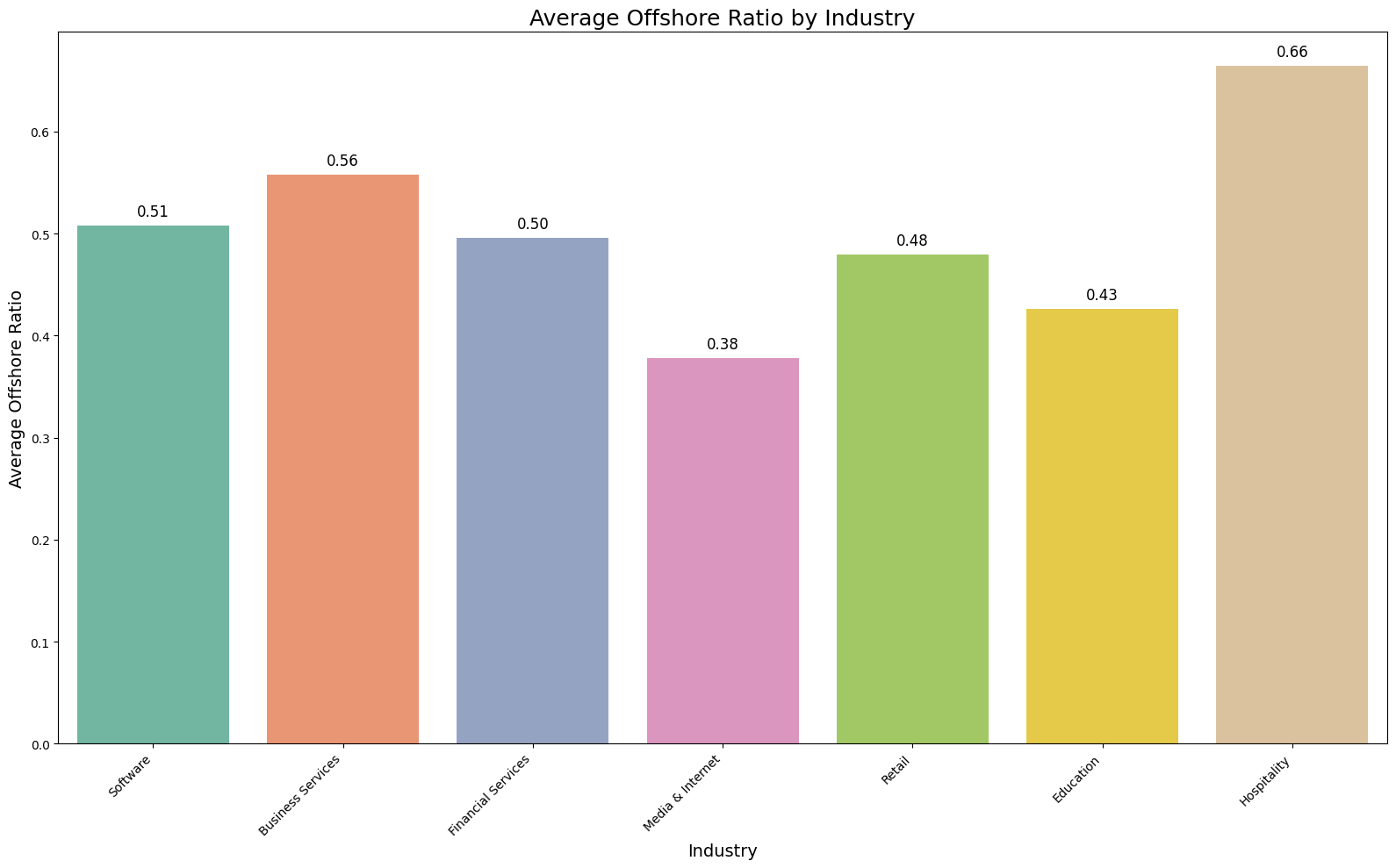

- Sliced by industry, companies in the Hospitality (70.7%), Retail (62.1%), and Business Services (60.9%) industries have the highest offshore ratios

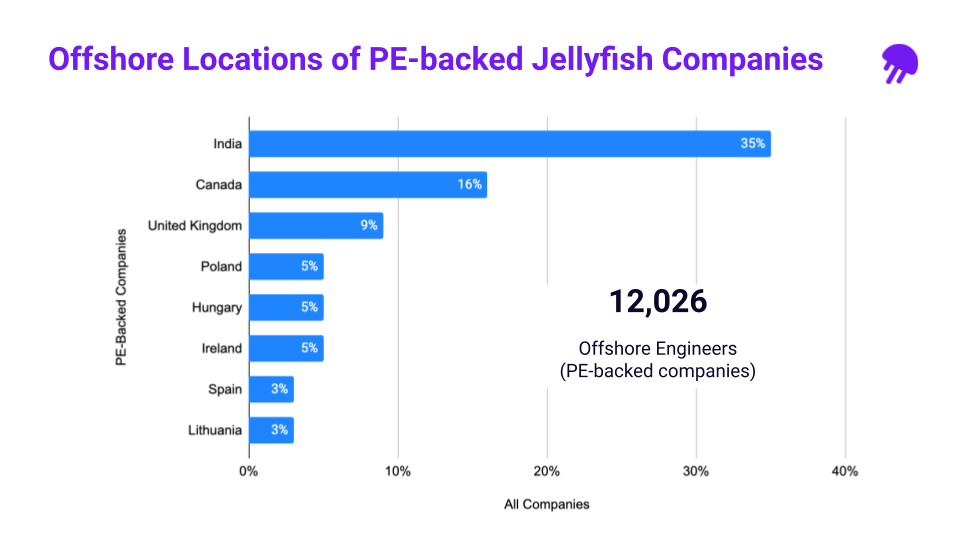

- PE-backed companies tend to have a higher offshore ratio (64.4% vs. 48.9% for all others). India (35% vs. 26%), Hungary (5% vs. 2%), and Lithuania (3% vs. 1%)

Historical Offshoring

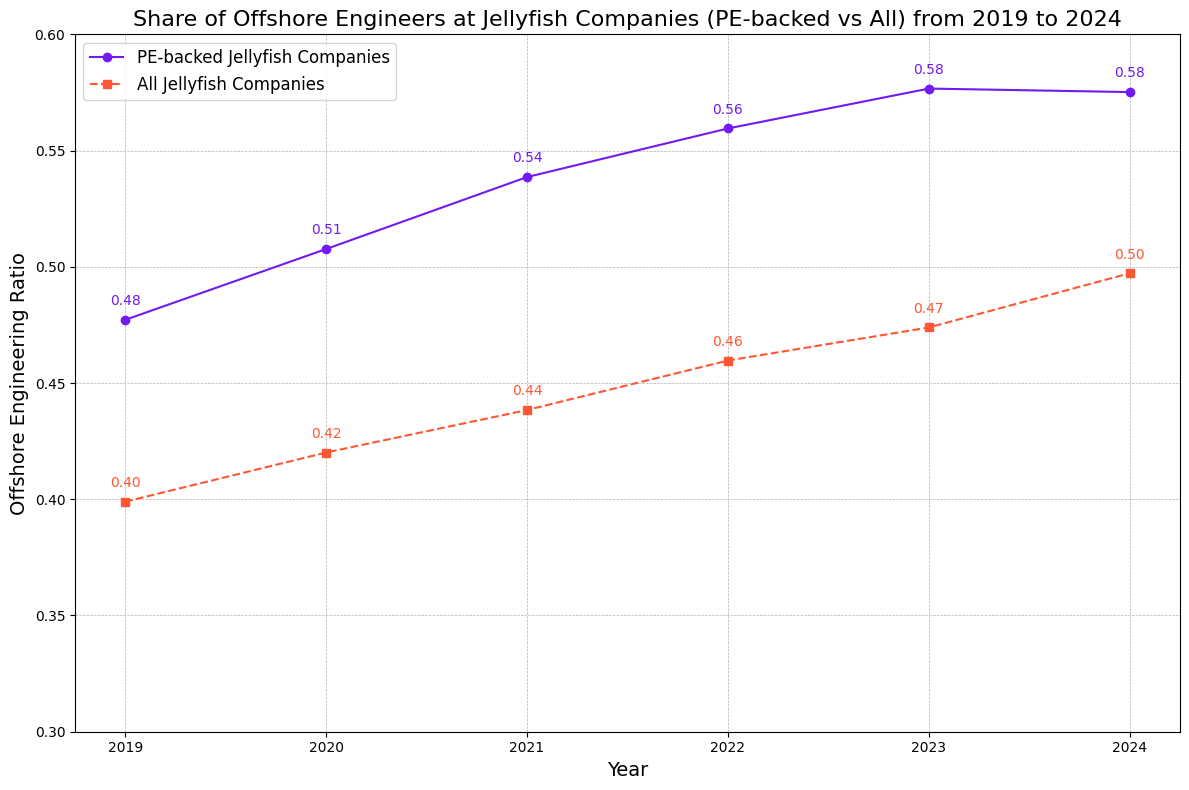

To assess how engineering offshoring has evolved over time, we analyzed six years of data from 174 companies, including 50 PE-backed organizations. This longitudinal view reveals key trends that shed light on the changing dynamics of global engineering talent allocation.We uncovered the following:

- As predicted, offshoring engineering talent has only increased over time. From 2019 to 2024, the share of offshore engineers across all companies rose by 9.8%, from 39.9% in 2019 to 49.7% in 2024.

- For PE-backed companies, the share of offshore engineers similarly rose by 9.8%, from 47.7% in 2019 to 57.5% in 2024.

- During that time, the biggest increases for offshoring engineers were seen in Canada (+5.4%), Romania (+1.3%), and Bulgaria (+0.9%). Countries that saw the biggest losses were India (-5.0%), Ireland (-1.1%), and Poland (-0.7%).

- Trends in offshoring locations were similar for PE backed companies, with the exception of Poland emerging as a source of growth (+2.2%).

Final Thoughts

Offshoring engineering roles has proven to be a strategic imperative for many companies – one that is reshaping global engineering operations. As industries continue to adapt to economic pressures and technological advancements, offshoring is poised to play an even more prominent role in the engineering landscape.