When developing software for internal use, companies face a crucial accounting decision: expense the development costs immediately or capitalize them as an asset? Understanding this choice can significantly impact a company’s financial reporting and strategic decision-making.

What is Software Capitalization?

What is Software Capitalization?

Software Capitalization is an accounting method where the costs of developing or acquiring software are treated as an investment (an asset) rather than an immediate expense. This applies to both internally developed software and purchased software like off-the-shelf applications or SaaS solutions.

Think of it like buying a piece of equipment for your factory. You wouldn’t expense the entire cost of the machine the day you buy it. Instead, you’d recognize it as an asset and depreciate it over its useful life.

Similarly, with software capitalization, the costs are recorded as an asset on the balance sheet and gradually expensed over time through amortization. This reflects the fact that the software is expected to provide benefits to the company over a period of time, not just in the period it was developed or acquired.

Companies can also capitalize external-use software.

When Can You Capitalize Internal-Use Software?

When Can You Capitalize Internal-Use Software?

You can capitalize internal-use software costs, but only under specific circumstances. Here’s a breakdown of the key criteria, primarily based on U.S. GAAP (Generally Accepted Accounting Principles) as defined under ASC 350-40:

1. Internal Use Only

The capitalized software must be developed solely for internal use within your organization. This means it’s intended to improve the efficiency of your operations, such as automating tasks, streamlining processes, or managing internal data. Software to be sold to external customers follows different accounting rules.

2. Application Development Stage

Capitalization is generally allowed during the application development stage. This is the stage where the actual building of the software takes place. It includes activities like:

- Designing the software’s architecture, user interface, and functionality

- Coding and writing the software program

- Testing the software to ensure it functions correctly

- Installing the software on your company’s hardware

Costs incurred before this stage (like preliminary research) and after this stage (like training and maintenance) are typically expensed.

3. Directly Attributable Costs

Only costs that are directly attributable to the software’s development can be capitalized. These include:

- Salaries and benefits of employees who are directly involved in the development process (e.g., programmers, software engineers, project managers)

- Fees for external consultants or developers hired specifically for the project

- Costs of materials and equipment used in the development process (e.g., software licenses, hardware components)

Indirect costs, such as general overhead and administrative expenses, are not eligible for capitalization.

Keep in mind that:

- Meeting these criteria doesn’t automatically mean you must capitalize. It simply means you have the option to do so.

- Accurate documentation is essential. You need to be able to clearly demonstrate that the software meets the criteria for capitalization and track the associated costs meticulously.

- Accounting standards can evolve. It’s important to stay informed about any changes to GAAP or other relevant accounting standards that might affect software capitalization rules.

- Consult with your accounting professionals. Your Certified Public Accountant (CPA) can provide guidance on applying these criteria to your specific situation and ensure you comply with all applicable accounting standards and properly account for implementation costs associated with the software.

Learn about recent clarifications from the IRS on IRC Section 174 for software capitalization and R&D expenditures.

Internal Software Capitalization Benefits

Internal Software Capitalization Benefits

Capitalizing internal-use software offers several key benefits that can significantly impact your company’s financial health and strategic decision-making. Here’s a breakdown of the advantages.

Financial Reporting and Performance

- Accurate expense recognition: Capitalization aligns expenses with the period when the software generates benefits, providing a more accurate view of your company’s financial performance over time as reflected in your financial statements. This avoids the distortion of expensing all costs upfront in the income statement, even though the software applications will be used for multiple years. This is particularly relevant for internally developed software with a long useful life.

- Improved financial metrics: Capitalization can boost key financial metrics, such as earnings per share (EPS) and return on assets (ROA). This can make your company appear more profitable and financially stable to investors and lenders.

Strategic Resource Allocation

- Long-term perspective: Treating software as an intangible asset encourages a more strategic, long-term approach to technology investments. This helps to ensure that software development efforts are aligned with your overall business objectives and contribute to long-term success.

- Better decision-making: Capitalization provides a clearer picture of the fair value of your software investments, which can lead to more informed decisions about allocating resources among competing projects. For example, if two software projects are being considered, capitalization can help assess their relative long-term value and prioritize accordingly.

Enhanced Software Sustainability

- Focus on quality: When software is recognized as a valuable asset, it encourages a greater emphasis on building high-quality, maintainable software applications with clean codebases. This leads to more robust and reliable software that can better support your business operations.

- Ongoing support: Capitalization incentivizes continued investment in maintaining and updating existing applications, ensuring their longevity and adaptability to future needs. This helps to maximize the return on your software investment and avoid potential impairment charges later on.

Promoting Innovation

- Freed-up resources: By spreading costs over time, capitalization can free up resources in the short term, allowing you to invest in other strategic areas, such as research and development or exploring new technologies. This could include investing in a new system or adopting a cloud computing arrangement.

- Support for DevOps: Capitalization can support the adoption of DevOps practices, which streamline the development phase, improve collaboration, and lead to faster, more efficient software delivery. This can help your company achieve technological feasibility for new projects more quickly.

Stages of Capitalizing Software for Internal Use

Stages of Capitalizing Software for Internal Use

Developing software for internal use can be a significant investment for companies. To properly account for these costs, it’s crucial to understand the stages of software development and how they impact capitalization. According to Accounting Standards Codification Topic 350-40 (ASC 350-40), capitalizing internal-use software costs depends on the nature of the costs and the development stage.

Stage 1: Preliminary Project Stage

This stage focuses on planning and research. Activities typically include:

- Conducting exploratory research

- Defining the desired functionality of the computer software

- Evaluating available technology to meet objectives

During this preliminary stage, all costs—whether internal or external—are expensed as they are incurred.

Stage 2: Application Development Stage

This stage involves the actual development of the software. Key activities include:

- Designing the software

- Coding

- Installing hardware

- Testing the software

The accounting treatment in this stage is more nuanced: and involvesboth capitalized and expensed costs.

Capitalized costs include:

- External direct costs (e.g., third-party development fees, software purchases, travel expenses directly related to development)

- Payroll and related costs for employees directly involved in development (allocated based on time spent on the project)

- Interest costs incurred during development

Expensed costs include:

- Training costs

- Data conversion costs (e.g., data purging, cleansing, reconciliation)

- General and administrative overhead costs

Capitalization begins when the planning stage concludes, management formally approves the project with committed funding, and it’s probable the project will be completed and the software used as intended. Capitalization ends when the software is substantially complete and ready for its intended use.

Stage 3: Post-Implementation/Operation Stage

This stage begins after the software is deployed and in use. Activities include:

- Training users

- Performing routine maintenance

All costs incurred during this operational stage are expensed.

As business needs evolve, the software may require upgrades or enhancements to add new functionality. These are treated like new development projects, therefore software development costs are capitalized or expensed according to the rules of the Application Development Stage.

Automate Software Capitalization with Jellyfish

Automate Software Capitalization with Jellyfish

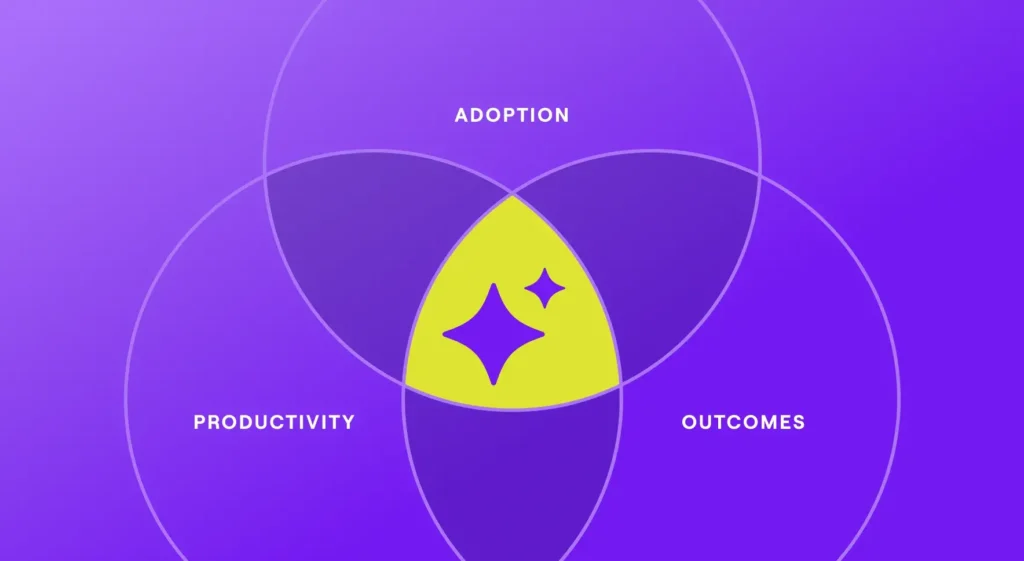

Software capitalization can significantly improve your company’s financial performance, but manual tracking is time-consuming and prone to errors. Jellyfish, an Engineering Management Platform (EMP), automates the process, accurately capturing engineering time spent on capitalizable projects. This ensures you comply with FASB and GAAP standards, optimize depreciation schedules, and streamline your accounting workflows.

To learn more about Jellyfish and how we can help with software capitalization, visit our website and request a demo today.

About the author

Lauren is Senior Product Marketing Director at Jellyfish where she works closely with the product team to bring software engineering intelligence solutions to market. Prior to Jellyfish, Lauren served as Director of Product Marketing at Pluralsight.