R&D Tax Credits are one of the aspects of software engineering that often are overlooked by, or in some cases are totally unknown to technical leaders. However, these incentives can save companies huge sums of money if used correctly, and in times when resources are scarce, that could mean the ability to build more for customers or to save engineering jobs. It can even mean the survival of the company. And while cost capitalization and applying for tax credits doesn’t traditionally fit into the role of CTO or VP of engineering, it’s important to work with your finance team or CFO to understand how you can help your company in this way.

What is an R&D Tax Credit?

R&D tax credits are incentives for companies who design, develop, or improve products, processes, techniques, formulas, or software. The credits can reduce past, current and future years’ federal tax liability, and therefore can result in immediate benefit. And these credits are not tax deductions, but instead provide dollar-for-dollar offset against taxes owed or paid.

The intention behind these credits are to incentivize companies to continue to invest in innovation and reward those who do spend increasing amounts of expenditure on research activities. Each year, tech companies and others who develop software pay millions of dollars in taxes. Many of these companies could be saving some of that tax money by applying for federal and state research and development tax credits, but either they don’t realize that the incentives can apply to them, or they simply don’t know about them.

In addition to federal tax credits, many states, such as California, New York, and Virginia offer these incentives. And for companies operating in the UK and Canada, these countries have their own programs. Canada’s Scientific Research and Experimental Development (SR&ED) tax incentive program, for example, should be particularly attractive for software companies operating there.

Does My Company Qualify for R&D Tax Credits?

By law, virtually any company that designs, develops or improves products, process, techniques, algorithms or software may be eligible to take advantage of R&D Tax Credits. As of 2016 this also includes startups, S-Corps and LLCs as long as they pay alternative minimum tax (AMT) with less than $50 million in average sales over the last 3 years. Even startups or companies who cannot yet recognize profits can claim the credits if they have less than $5 million gross receipts and sales in 5 or fewer years. In these cases they can be used to reduce FICA payroll tax up to $250k annually.

Examples of R&D Tax Credits

- Team working on a new software product or service

- Team working to improve or add new features to an existing product or service

- Team working to improve development processes to create greater efficiencies

If your team falls into one of these categories, and it uses an iterative process to execute these activities based on hard sciences, such as engineering or computer sciences, the time your team members log on these activities can qualify for the credit. In this case, your management team would be smart to understand where you qualify and take advantage of any applicable credits. Your auditor or accountant will probably be your best bet to help you here, and many accounting firms have dedicated services. PWC’s specialized research and development credit services provide some great resources to check out and get started.

Challenges of R&D Tax Credits

As with most incentives from government programs, applying for these credits can require a significant amount of work. The biggest challenge for most companies will be quantifying an accurate amount of engineering time that was logged against activities that qualify for credits. It is certainly doable. You could do this with a simple spreadsheet and some dedication to regularly logging engineering activities. But the truth is, this can be a time and labor intensive endeavor, and unless companies have been diligently tracking activities, creating an auditable report can be daunting. Many companies will even hire tax advisory or consulting firms to help them manually identify these activities through research, interviews, and extensive reporting.

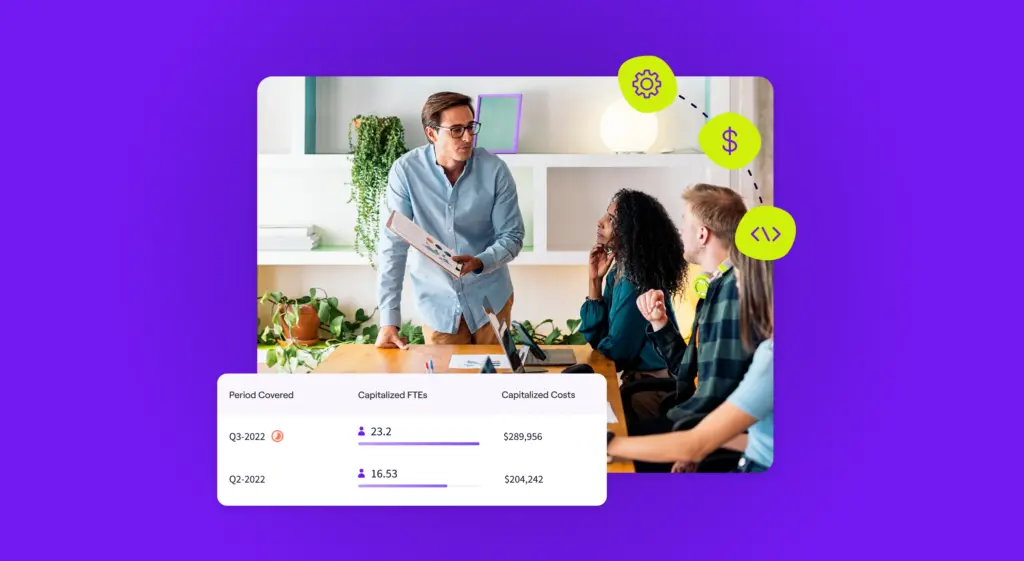

How Jellyfish Simplifies the R&D Tax Credit Process

Jellyfish is an engineering management platform, which automatically measures the amount of time engineers are spending specific tasks and projects based on signal from the systems developers use to track and integrate their code. This allows us to construct accurate and auditable management dashboards of activity by team, and importantly, by deliverable and type of work (was this new feature work or sustaining engineering, bug fixes or something else?). Because of the way developers already use these systems, we find this measurement to be more consistently reliable than self-reported time tracking, which tends to be a “best guess” at key projects and often neglects to account for time spent on less complicated or less important work. Jellyfish has found this approach to be well-suited for providing an auditable, best-available measurement of the amount of engineering effort spent on capitalizable and tax-creditable projects, greatly simplifying the process of R&D cost capitalization and the tax credit application process.

The takeaway, of course, is that technical leaders and finance teams at tech companies should not overlook R&D tax incentives for your company. Do some homework to understand the credits available where your company operates. You might just earn your company some significant extra cash.

If you’d like to learn more about Jellyfish and how we can help with R&D cost capitalization and tax credits, visit our website and request a demo today.