Navigating tax regulations can be complex and particularly daunting for software companies, given the dynamic and innovation-focused nature of their operations. Section 174 of the United States Internal Revenue Code (IRC) presents specific challenges and opportunities for such businesses, directly influencing their financial strategies and reporting. Here’s a comprehensive overview of what Section 174 entails, its recent implications, and a strategic solution to manage the complexities it introduces.

What is Section 174?

Section 174 is a tax provision that allows businesses engaged in research and development (R&D) activities to deduct relevant expenses from their taxable income. This includes not only traditional R&D, but also software development costs that meet the prescribed criteria. The provision stipulates that these expenses can be either capitalized or deducted in the tax year they are incurred, depending on the nature of the R&D activity, further influencing the timing of tax liabilities and cash flow for qualifying companies.

Compliance with Section 174 requires thorough documentation and scrutiny of R&D expenditures, as well as adherence to specific IRS guidelines to ensure deductions are accurate and supportable.

The Impact of Section 174 on Software Businesses

For the software industry, understanding and managing Section 174 is crucial. Before the provision, software firms could expense R&D costs immediately, reducing their tax burden in the current period. However, under current rules, these expenses often need to be capitalized, affecting when they are recognized for tax purposes.

This can significantly affect the tax liability and financial reporting of software companies, especially those on the cusp of profitability. By requiring certain expenses to be amortized over time, Section 174 has the potential to impact the timing of recognizing expenses against revenue, potentially influencing reported profitability and available tax credits in a given year.

Recent Changes and Clarifications to Section 174

With such implications for software businesses, it is important to stay abreast of any changes or clarifications in the application of Section 174. The IRS has recently issued updated guidance, in Notice 2024-12, refining aspects of the provision to provide clearer and more specific rules.

Two significant updates directly affect the software industry:

Defined Overhead Costs

The IRS now specifies a more precise definition of overhead costs related to R&D, which can be allocated as part of software development expenses. This includes costs beyond salaries such as rent, utilities, and software licenses. These delineated and clarified overhead costs can aid in more accurate and beneficial capitalization assessments.

Refined Definition of “Software Development”

This update serves to minimize ambiguous interpretations of what constitutes software development. By offering a clearer and more structured definition, the IRS’s guidance helps software companies categorize their activities and expenses more coherently.

How Controllers Can Take Advantage of Section 174

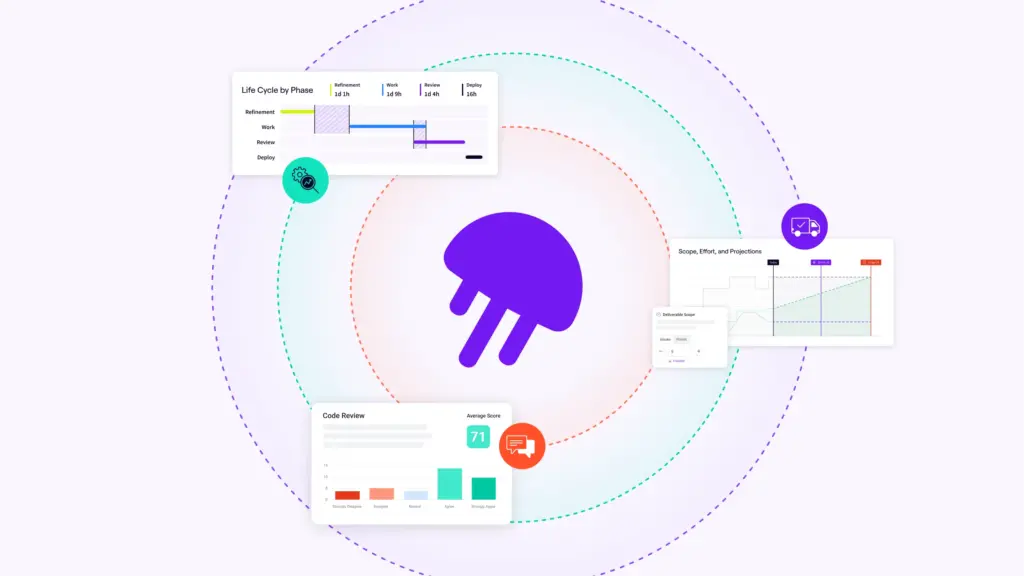

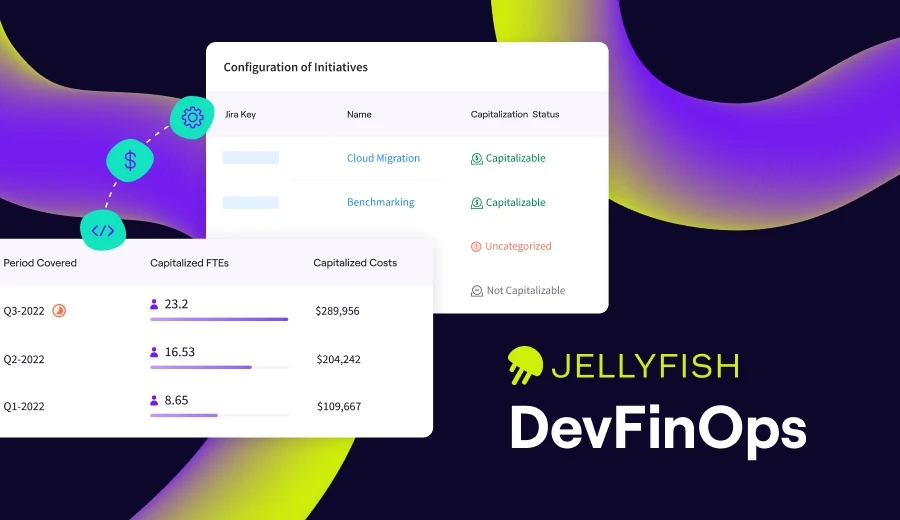

Navigating Section 174 compliance and strategic decision-making in the software industry is a formidable task. Enter Jellyfish DevFinOps, a platform designed to streamline the process of recognizing and documenting R&D activities to ensure businesses are maximizing their deductions while complying with Section 174.

Jellyfish automates the labor-intensive process of identifying, categorizing, and documenting R&D expenses, particularly those associated with software development. By leveraging Jellyfish’s capabilities, software companies can:

- Efficiently categorize different types of R&D work as either capital or expense

- Provide detailed contemporaneous documentation for their R&D efforts, which is crucial for Section 174 compliance

- Offer a user-friendly interface that minimizes the burden on engineering teams while providing finance and tax professionals with the information they need

Jellyfish’s tech-forward approach translates to more accurate and compliant tax reporting, significant time savings for both finance and engineering teams, and ultimately a streamlined approach to managing the tax implications of R&D in the software industry.

Get More Tax Savings, Enhanced Fiscal Performance

Software companies must remain diligent and innovative in managing the impact of Section 174 on their financial health and agility. By staying informed of recent changes, efficiently maintaining compliance through robust documentation, and strategically leveraging tools like Jellyfish, these businesses can turn the potential challenges of Section 174 into opportunities for tax savings and enhanced fiscal performance.

Jellyfish offers this information as general guidance only and does not offer legal advice, tax advice, accounting services, or investment advice. Please consult your own tax, legal, or accounting advisor before making any transactions.